Does Your Portfolio Fit Your Needs and Goals?

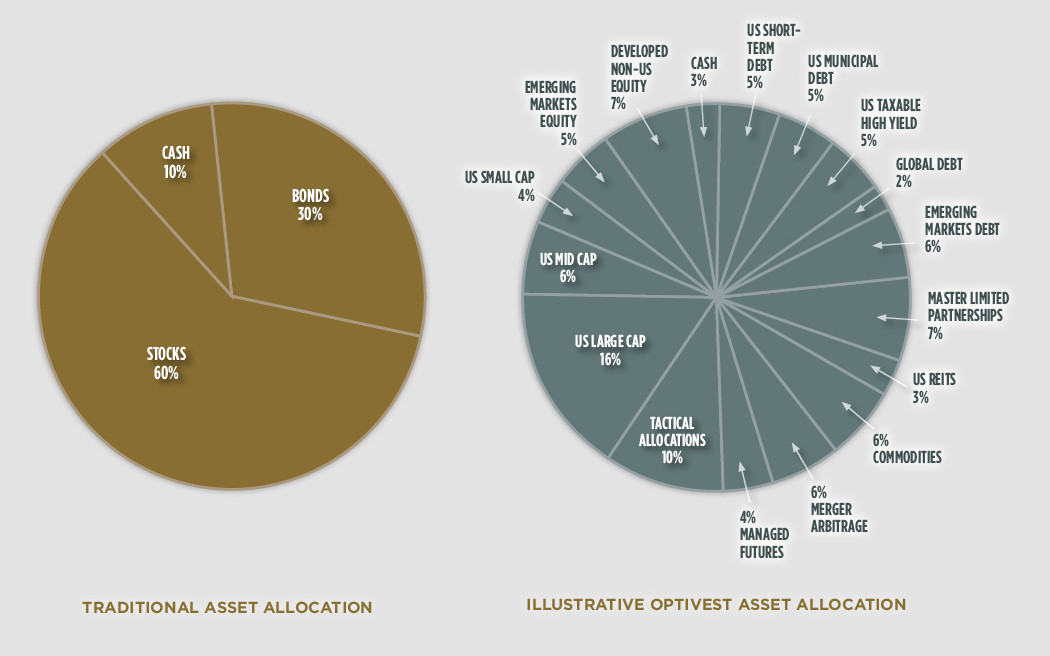

At Optivest, we believe that a properly diversified portfolio goes well beyond the typical mix of stocks, bonds and cash. Optivest utilizes sophisticated forecasting tools to audit investment cycles, current vs. historical valuations and statistical probabilities of return to determine the right mix of investment vehicles to meet our clients’ needs.

As a full-service investment management firm, we realize that every client is unique and therefore we start by conducting an extensive fact finding and risk tolerance sensitivity process. Once we fully understand each client’s unique background, financial situation and objectives, we begin the process of creating an “optimum investment” portfolio for their specific risk profile.

We believe that a properly diversified portfolio goes well beyond the typical mix of stocks, bonds and cash.

Asset Allocation & Portfolio Construction:

Our always current investment discipline is balanced with our client’s unique investment objectives, thus arriving at portfolios that are far more diversified than the typical stock, bond and cash allocations – many invested across multiple asset sectors. Tactical portfolios are developed, stress-tested against varied potential market conditions and calibrated to target specific income and growth returns.

g