We see investments as more than just products; we see them as answers to specific client goals. The optimum portfolio allocation targets low volatility utilizing a strategic blend of securities, fixed income and real estate. Including these specialty growth and high cash flow investments truly balances and protects portfolios, providing the peace of mind you desire.

Turning success into peace of mind requires that risk become the first order of business.

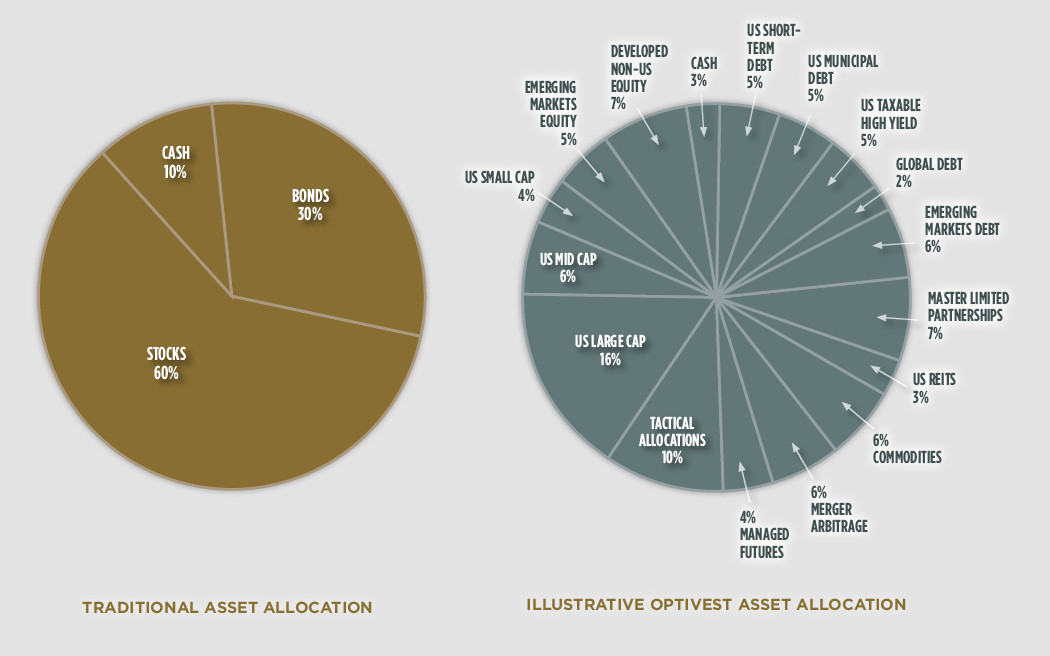

Whether your investment goals are monthly income, annual growth or a combination of both, our investment decisions are based on a diversified approach to investing. We provide our clients access to investments that truly balance their portfolios, incorporating traditional securities, specialty income products, and real estate.

Traditional Management:

→ Optivest utilizes sophisticated research and support offered by numerous tools and companies such as Morningstar, Credit Suisse, Goldman Sachs and PIMCO to continually research the track records, philosophy of management, and personnel history of all programs that we recommend. As experienced financial market professionals, we know the questions to ask and how to determine which programs have a high degree of probability in reaching their stated objectives. Optivest is perpetually evaluating the general economy, inflation, interest rates, U.S. and foreign stock markets, broad commodity prices as well as real estate.

Hedged Stock Management:

→ These non-correlated stock market investments, in both hedged stock funds and fund of funds, have helped Optivest accounts maintain uncorrelated returns during periods of time that traditional stock markets are flat or negative.

Real Estate:

→ Optivest is actively investing with highly experienced managers and operators of hotels, assisted living centers, medical office buildings, public storage facilities, retail, office, apartments, and critical business infrastructures. These are all structured through private REITs or private Reg-D offerings. We partner only with the managers whom we feel are experts in each of the above mentioned areas.

→ We diversify our real estate allocations among the five primary real estate property groups: hotels, office, retail, industrial/commercial and multi-family. These investments are made through highly experienced acquisition and management professionals, geographically diversified across the country. We also offer development projects in hotel, office, medical, retail, apartment and self storage.